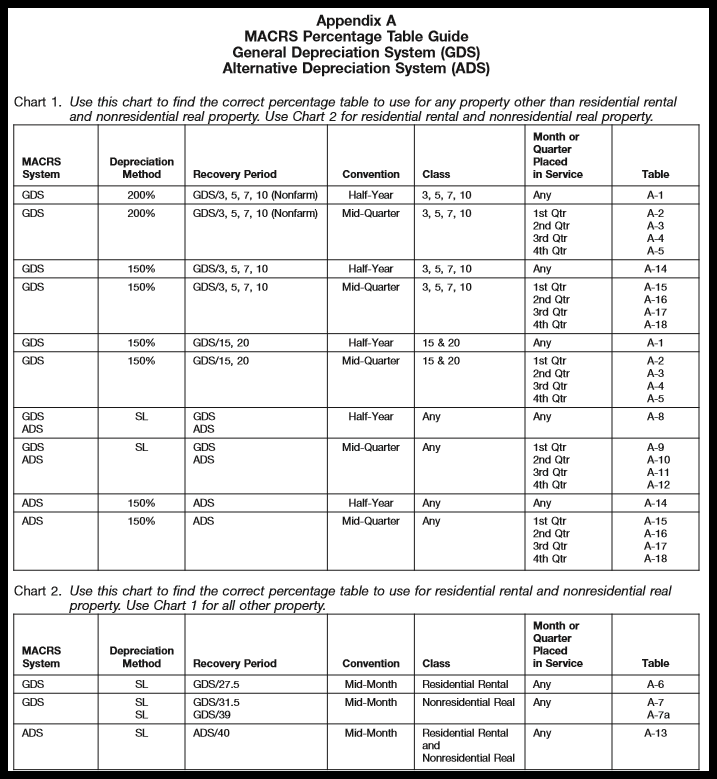

2025 Bonus Depreciation Percentages

2025 Bonus Depreciation Percentages. The tcja allows businesses to immediately deduct 100% of the cost of eligible property in the year it is placed in service, through 2025. For vehicles under 6,000 pounds in the tax year 2025, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of.

2025 Vehicle Bonus Depreciation Debi Mollie, For vehicles under 6,000 pounds in the tax year 2025, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of.

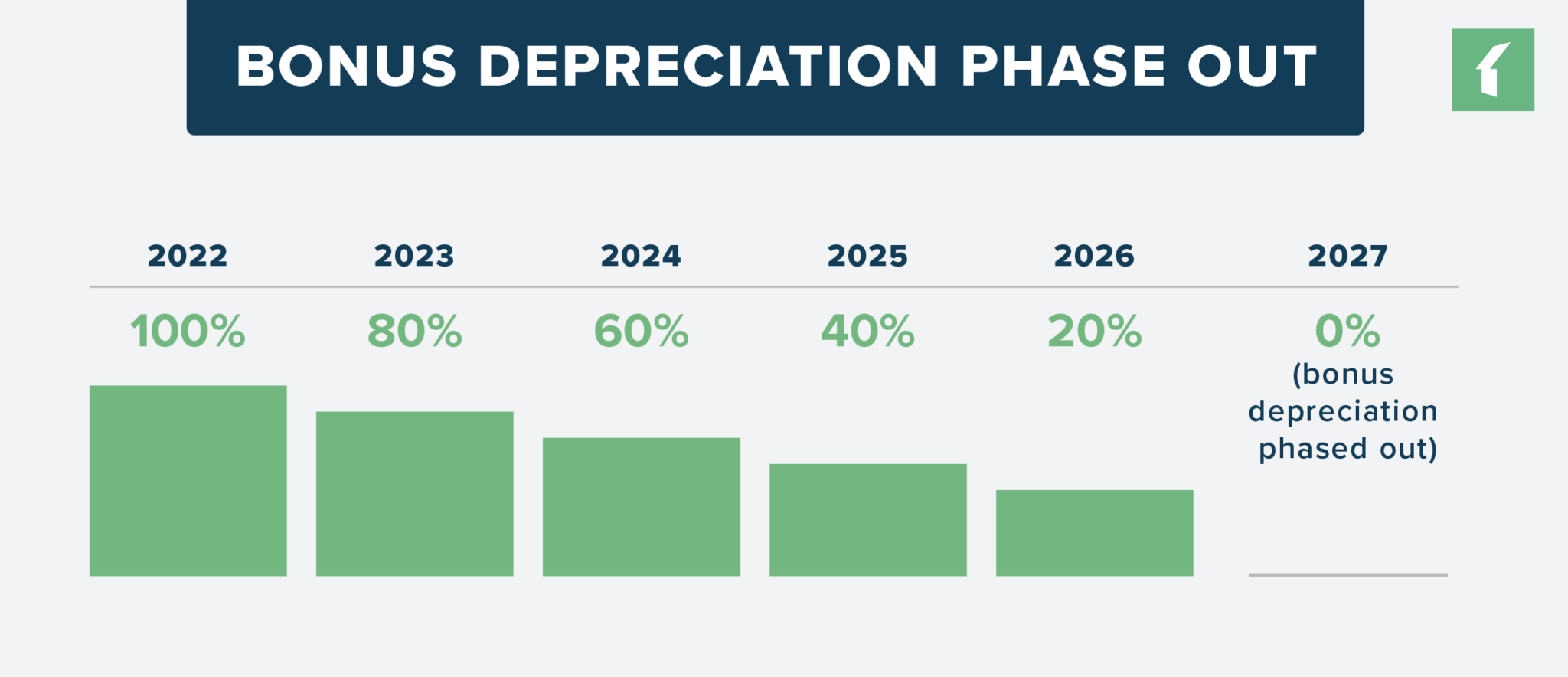

Bonus Depreciation Rate For 2025 Aleda Aundrea, In 2025, the bonus depreciation is scheduled to fall to 60%, which means businesses should carefully plan their investments in the coming years to maximize tax benefits.

2025 Bonus Depreciation Percentage Table Debbie Kendra, To maximize the benefits of bonus depreciation, businesses can consider the following.

Bonus Depreciation Calculator 2025 Nola Terrye, Earlier, it had split one equity share with a face value of ₹10 into ten equity shares of.

8 ways to calculate depreciation in Excel (2025), 60% (decreased from 80% in 2025, falling by 20% each year until phased out in 2027) this means for 2025:

Bonus Depreciation Limits 2025 Dita Donella, The impact of tax reforms on bonus depreciation in 2025 is an important consideration for businesses planning on leasing equipment.