Avoid Common Tax Mistakes With 2025 Brackets

Avoid Common Tax Mistakes With 2025 Brackets. You pay tax as a percentage of your income in layers called tax brackets. However, the income thresholds that determine which.

7 common tax mistakes that can delay your tax refund in 2025. One of the most common tax mistakes is submitting a return with missing or inaccurate information.

Some of the most common mistakes are missing or inaccurate social security numbers, misspelled names, choosing the wrong filing status, math mistakes (addition, subtraction, or using a minus sign.

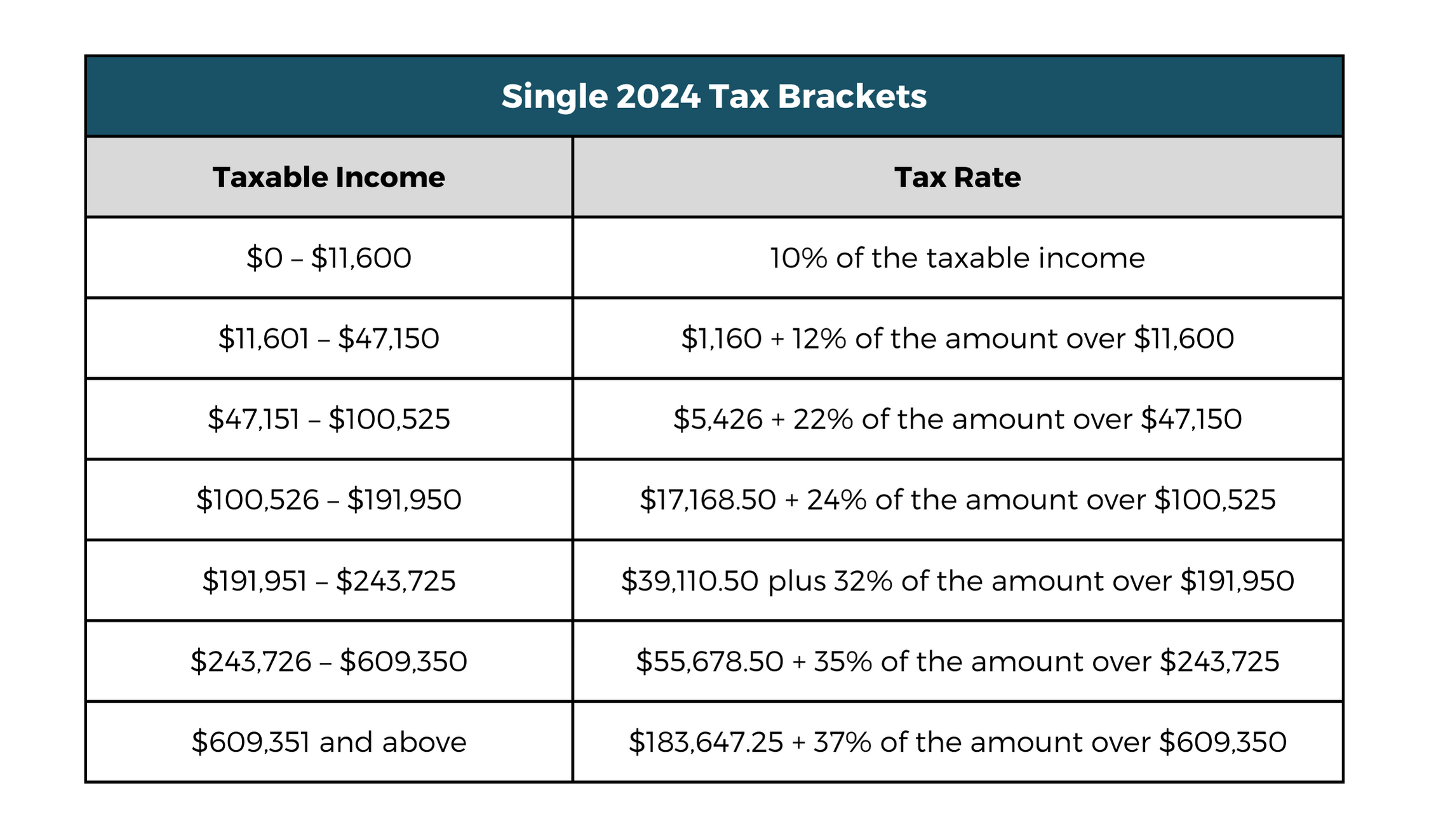

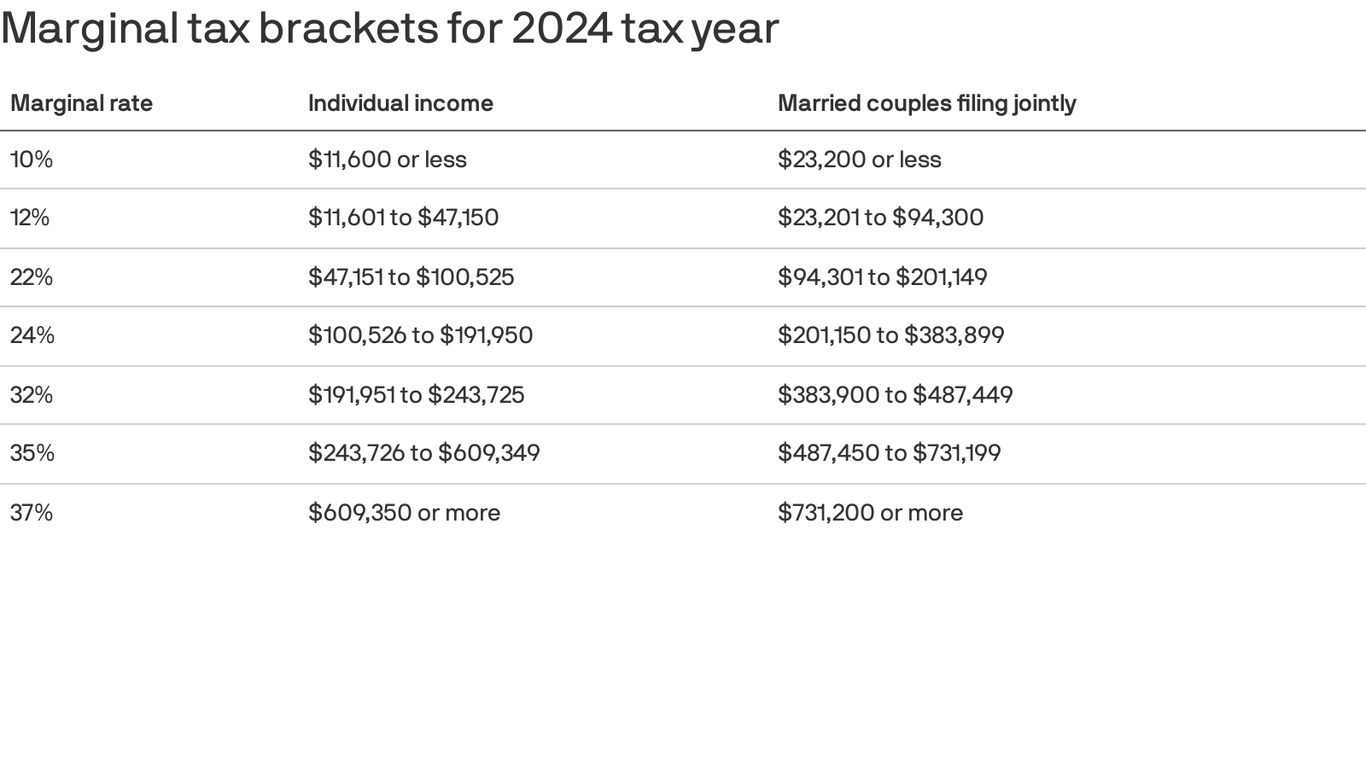

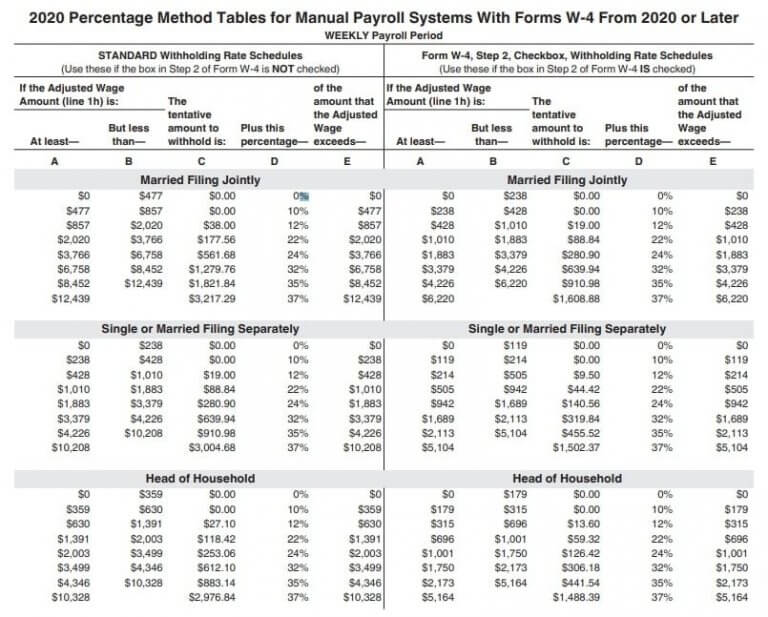

Tax Brackets 2025 What I Need To Know. Jinny Lurline, Here are the mistakes that. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

TTT Financial Group Common tax mistakes to avoid in 2025, This is why your paycheck could be bigger this year. Don’t duck employer tax obligations by labeling employees as independent contractors when they’re under your control.

2025 tax brackets Archives Optima Tax Relief, The irs is continually on the lookout for this. In 2025 (for the 2025 return), the seven federal tax brackets persist:

Navigating 2025 Tax Brackets A Guide for the Tax Season, Durkin asked geltrude about common. Story by courtney johnston • 1w.

2025 tax brackets IRS inflation adjustments to boost paychecks, lower, However, the income thresholds that determine which. You pay tax as a percentage of your income in layers called tax brackets.

Common Tax Mistakes to Avoid during the 2025 Tax Season, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). These are the taxes you’ll file in 2025.

10 Common Mistakes to Avoid When Filing Company Taxes, In 2025 (for the 2025 return), the seven federal tax brackets persist: If you fail to file your taxes and fail to file for an extension, the penalties are severe.

Federal Tax Brackets 2025 Jodee Lynnell, Volatility is a feature of investing, not a. For more tax tips , check out our tax filing cheat sheet and the.

Avoid These Common Mistakes In Filing Tax Returns, Present clear and concise answers, adhering to prescribed word. 7 common tax mistakes that can delay your tax refund in 2025.

Common Taxpayer Mistakes to Avoid SG INC CPA, There are seven federal tax brackets, and they will remain the same as 2025 — 10%, 12%, 22%, 24%, 32%, 35% and 37%. These are the taxes you’ll file in 2025.