Hsa Limits 2025 Include Employer Contributions

Hsa Limits 2025 Include Employer Contributions. The 2025 individual 401 (k) contribution limit is $22,500, up $2,000 from 2025. Hsa limits 2025 include employer contribution and employer.

The health savings account (hsa) contribution limits increased from 2025 to 2025. The 2025 calendar year hsa contribution limits are as follows:

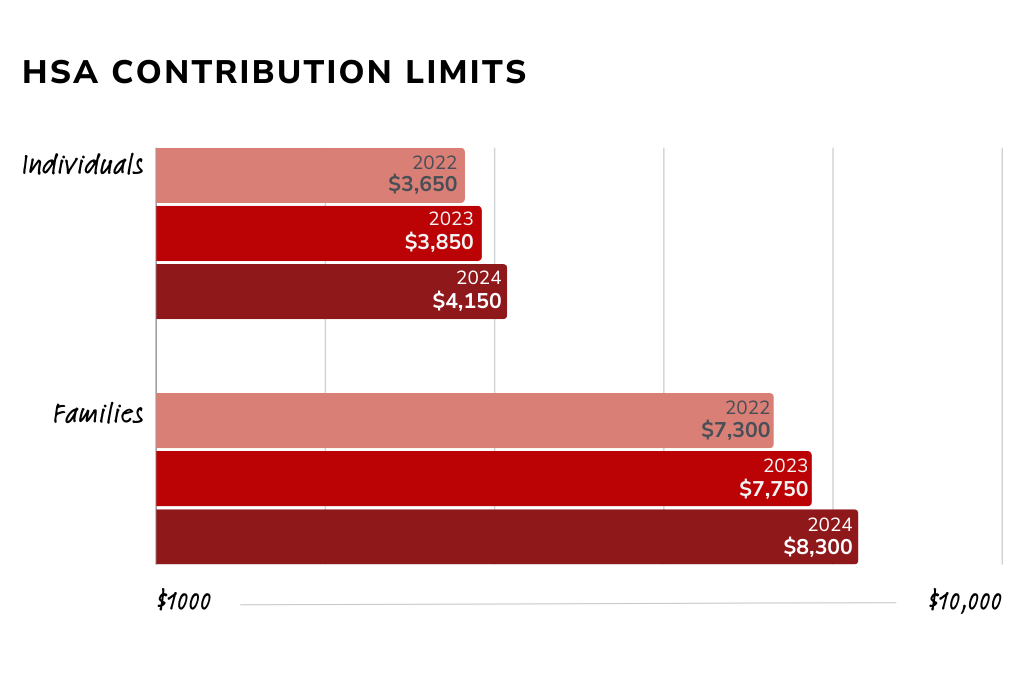

Hsa Contribution Limits 2025 Employer Contribution Aggy Lonnie, The 2025 hsa contribution limit for individual coverage increases by $300 to $4,150. Annual hsa contribution limit 2025.

HSA/HDHP Limits Will Increase for 2025 Gulfshore Insurance, Federal income tax withholding from the gross bonus amount (22% for bonuses under $1 million). Your contribution limit increases by $1,000 if you’re 55 or older.

Take Advantage of the HSA Contribution Limit Increase in 2025, What are the rules for employer hsa contributions? The new tax regime impacts both.

HSA Contribution Limits Set to Increase in 2025 SJHL, The health savings account (hsa) contribution limits effective january 1, 2025, are among the largest hsa increases in recent years. The health savings account (hsa) contribution limits increased from 2025 to 2025.

IRS Releases HSA Contribution Limits for 2025, The health savings account (hsa) contribution limits effective january 1, 2025, are among the largest hsa increases in recent years. Hsa contribution limits for 2025.

IRS Announces 2025 HSA Limits Blog Benefits, Increase in standard deduction limit. Contribution limits for simple 401 (k)s in 2025 is $16,000.

Irs Hsa Catch Up Contribution Limits 2025 Mandy Kissiah, The 2025 hsa contribution limit for individual coverage increases by $300 to $4,150. Contributions from all sources—including employer 401 (k) matches and profit.

Significant HSA Contribution Limit Increase for 2025, Contribution limits for simple 401 (k)s in 2025 is $16,000. Hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families.

IRS Announces 2025 HSA Limits Inova Payroll, Considerations for 55+ employees in 2025. The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025.

HSA/HDHP Limits Will Increase for 2025, For 2025, you can contribute up to $4,150 if you have individual coverage, up. Federal income tax withholding from the gross bonus amount (22% for bonuses under $1 million).

Here's what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually.

The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families.

Hsa Limits 2025 Include Employer Contributions. The 2025 individual 401 (k) contribution limit is $22,500, up $2,000 from 2025. Hsa limits 2025 include employer contribution and employer. The health savings account (hsa) contribution limits increased from 2025 to 2025. The 2025 calendar year hsa contribution limits are as follows: Hsa Contribution Limits For 2025. Considerations…