When Do Taxes Have To Be Filed 2025

When Do Taxes Have To Be Filed 2025. To amend the south carolina code of laws by amending article 1 of chapter 23, title 50, relating to the titling of watercraft and outboard motors, so as to delete the requirement. This is typically 5% of the unpaid taxes for each month the return is late, capped at.

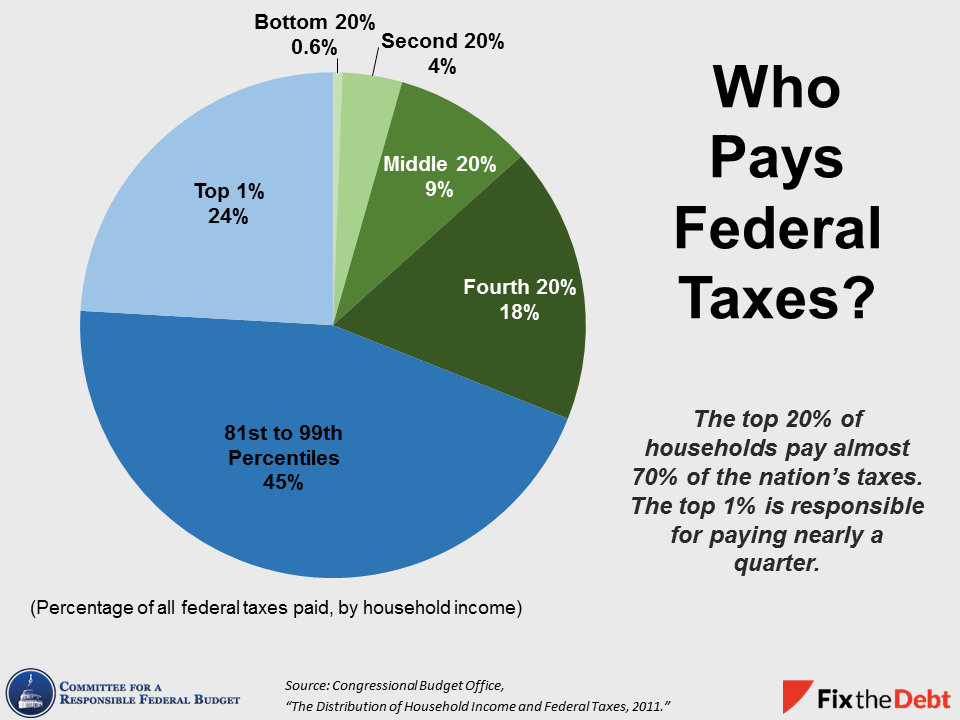

10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). For individuals, the last day to file your 2025 taxes without an extension is april 15, 2025, unless extended because of a state holiday.

What Time Do Taxes Have To Be Filed 2025 Sarah Cornelle, Refer examples and tax slabs for easy calculation.

Last Day To File Tax 2025 Online Megan Knox, Some americans have a different due date, however, and state filing deadlines are all over the.

When Can I File 2025 Taxes Rosy, Key tax deadlines are coming up in 2025 for llc and corporation businesses.

When Do Taxes Need To Be Done 2025 Otha Tressa, Baraka has said he wants to reduce taxes for households making $90,000 per year or less, add a 2 percent tax increase for those making more than $10 million, and reverse.

.jpg?width=3333&name=tax graphic_2020 (1).jpg)

Tax Day deadline What time do taxes have to be filed by?, The new regime offers lower rates of taxes but permits limited deductions and exemptions.

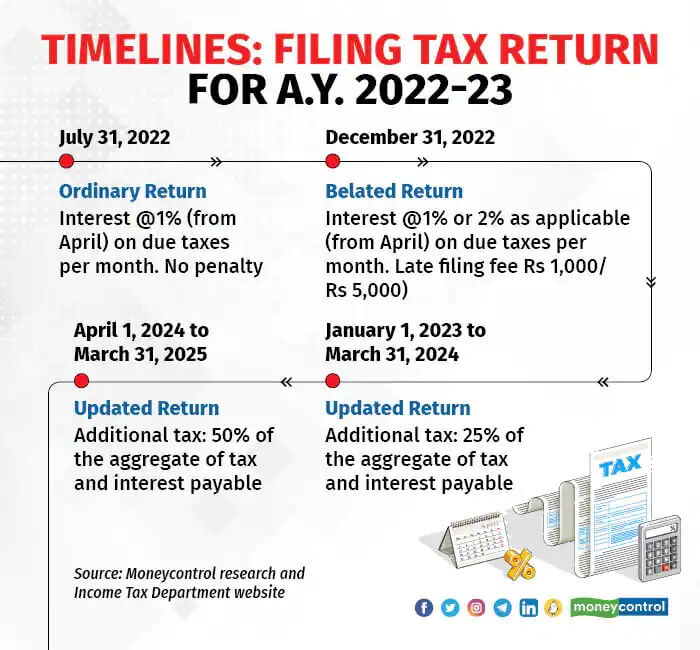

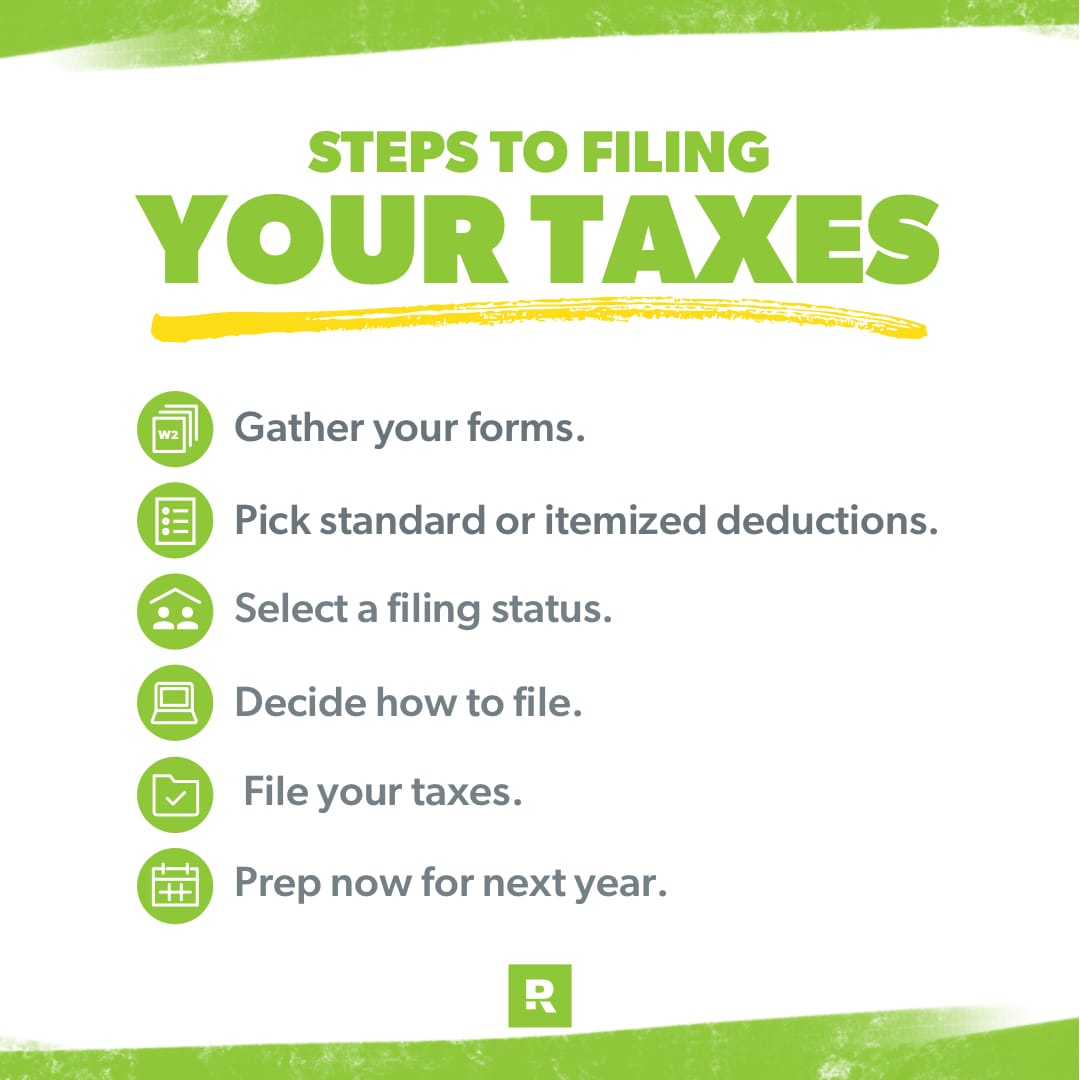

Still Don’t Understand Tax Filing? Here’s A Complete Guide For, This is the standard deadline unless april 15 falls on a weekend or public holiday, in which case the deadline moves to the following business day.

When Do Taxes Have To Be Filed In 2025 Perri Brandise, The new regime offers lower rates of taxes but permits limited deductions and exemptions.